NIBE News

Want to read more about NIBE? Simply select the year you are interested in!

Categories:

- Select a year

- 2022

- 2023

- 2024

- 2025

NIBE strengthens Scottish distribution through new partnership with William Wilson

09/12/2025

NIBE launches nationwide Virgin Radio Network sponsorship to spotlight the UK’s shift toward low-carbon home heating

25/11/2025

NIBE wins national award for pioneering quiet, high-performance heat pump technology

24/10/2025

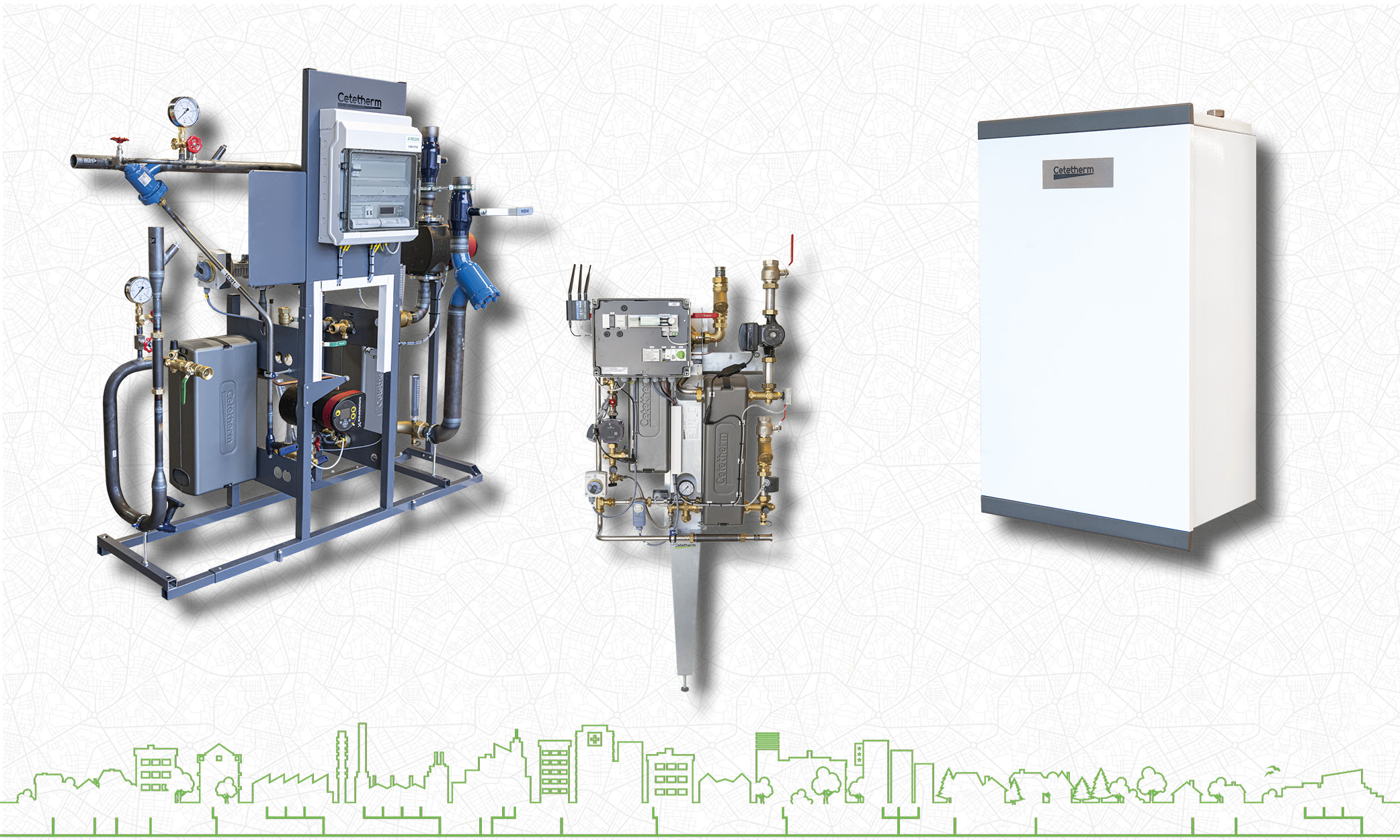

NIBE Adds Heat Network Solutions to UK Portfolio with Cetetherm Pioneer HIU and substations

19/08/2025

NIBE UK Joins GMCA Net Zero Housing Retrofit Framework to Support Greater Manchester’s Low Carbon Goals

30/07/2025

NIBE unveils direct-to-consumer channel and new training partnership at record-breaking InstallerSHOW 2025

09/07/2025

NIBE Launches First UK Show Apartment Showcasing Sustainable Heating Innovation

01/04/2025

We need all types of heat pumps to decarbonise UK homes” says Paul Smith, MD for NIBE.

06/12/2024

A step in the right direction but more needs to be done, says Paul Smith, MD for NIBE

31/10/2024

The House of Lords Committee has found that the Boiler Upgrade Scheme is failing to deliver

22/02/2023

Grand Reopening of NIBE’s Newly Refurbished Chesterfield Heat Pump Training Academy

2022

Innovative New Photovoltaic-Thermal Collectors for Heat Pumps Launched by NIBE Energy System

2022

NIBE Pro – an industry-leading training and support scheme for heating installers

2022

Showcasing your heat pumps installations with a case study – the power of story telling

2022

Press Contact: Natalie Glorney (PR Manager)

Direct Phone Number: +44 7908 078084

Email: natalie.glorney@nibe.co.uk

Funding in the UK

Discover available grants

.jpg)

%20Image%201.webp)

%20Year%20End%20Report%202019.webp)

.webp)